In our short existence one thing has become clear: the fragility of the relationship between regulators, insurers and the insured. The imperfectly operating power cable O&M market is creating a trajectory that is in danger of heading into troubling waters. We feel a deep dive into these issues was worthy of an extended post into a blog article.

In the UK like other markets, the workings are intended to be simple: The export infrastructure (offshore substation to onshore substation plus export cable – an OFTO here in the UK – Offshore Transmission Owner, TSO in Europe – Transmission System Operators) is owned and operated by a different body from the windfarm operator or developer. Once operating the transmission assets are sold to a separate body with warranties from the developer and assurances from the state.

This allows the grid connection to be controlled and creates a break between demand and supply to effect some regulation of the marketplace and avoid any of the three parties being held to ransom. OFTO’s take insurance from the market and OFGEM (in the UK) regulates the activities with the ability to provide cover in the situation where insurance is difficult or losses ungovernable. The nation is committed to offshore wind as part of our legally binding net zero targets and if systemic or other issues cause a failure in this fragile arrangement the buck will stop with the consumer via higher electricity prices.

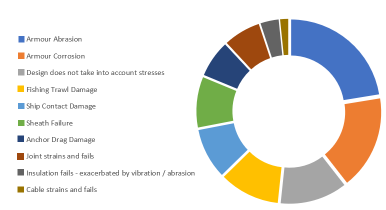

Export Cables are known to be a big issue in this mix. We know that around 80% of insurance claims are caused by cables – this comes from a mixture of legacy design issues, deployment issues, environmental issues and those originating from human activity. It’s also often incorrectly stated that the majority of failures are down to human activity. A growing body of literature is probing the root causes of failure with solid evidence developing within academia and independent bodies such as ORE Catapult and CIGRE that show this is not the case.

The true picture of failures is a veritable mix of sources from human error, design error, deployment error magnified or augmented by the action of the environment. Many of these overlap and for example a minor issue unnoticed in production or deployment will be exacerbated if the environment becomes dynamic. Additionally, the early pioneers of wind have suffered badly with some design flaws coming to light years later and prove an expensive headache for all concerned.

The role of insurance

Today in 2023 as a result, it’s commonly stated that insurers have not had sufficient “non claimers” to fund the “claimers” in their portfolio with many considering their efforts “loss making”. Why is this?

Well, the opaque nature of the sea lies at the heart of this. The OFTO or operator has very few tools at their disposal to understand the condition of their cables and the nature of their interaction with the environment. This leads to the depressingly common situation where all cable failures become an insurance claim.

Well surely that’s reasonable and that’s the point of insurance? Is the market not just trying to operate at too low a cost? Well let’s visit that – the purpose of insurance is to transfer unpredictable risk from the asset owner and put it in the hands of a bulk owner who assesses the risk and prices accordingly. It works well on unpredictable cases. In our current world if you have no knowledge, ANY failure is unpredictable and therefore ALL failures are indeed an insurance case.

Owners are both encouraged and obliged to check their cables – and this will typically take the form of an occasional and expensive survey to either measure the height of the seabed by towed or hull mount sonar or carry out a slow, step by step video survey by tone-locking ROV to confirm cover and exposure. Again, the key risk being considered here is exposure and propensity to damage from human activity.

Although imperfect and occasional this is fine – but it omits a huge class of potential failures and degradations that are invisible – such as abrasion of armour, fatigue in sheathing, erosion of FO tube and defects either from manufacturing or from cable deployment. In this case now where gradual degradation suddenly expresses itself as failure, the OFTO legitimately states “we knew nothing about it”, the insurer ends up paying out albeit often with a high deductible. Policy prices spiral and deductibles inflate.

To make matters worse if a technology arrives to put a spotlight on the cable’s condition – it may perversely be considered a penalty to install it – after all if a technology points out flaws that may not become failure they immediately break the rule of “unpredictable” so guess what – degrading cables are excluded and the operators may be left in a perceived “worse” state. As well as increasing premiums and deductibles, we also have the reality of decreasing cover. Of course the situation where erroenous identification of deterioration needs to be guarded against by proper technology validation and verification which is where our industry body stakeholders need to step in.

We’ll return to this, but first let’s consider the actions of our regulator OFGEM. OFGEM are essentially becoming the insurer of last resort – and they are unhappy with that position. By licence OFTO’s are not directly encouraged to investigate new technologies and essentially have to use proven technology to change their maintenance regime – i.e. the maintenance pot is fixed and if they wish to move money into a new basket it has to come out of the fixed pot. Worse still – where an unpredictable failure that insurance will not cover the bill comes back to the public as an IAE (Incoming Adjusting Event) hitting our future bills. In their most recent case the language is very negative – it’s not a place they want to be – referring to “reasonably foreseeable” failure but at the same time the “unavailabity of insurance” and crucially “the Licensee did not have the opportunity to manage the risk” – so what about a better future where they do?

So what needs to change?

Fibre Optic sensing technologies exist that can carry out location by location integrity assessment – a fibre that is ALREADY in the cable can provide information on temperature, strain, vibration, fatigue, exposure state, electrical response and more – we call these Distributed Fibre Optic Sensing (DFOS).

Those with decaying cables or troublesome conditions can immediately take the benefit of condition monitoring in a palliative care scenario where for example live or regular monitoring of cable performance creates a feedback loop to either limit conditions or influence pre-emptive repair. But this is solely the domain of the “uninsurable”. Surely the market could do better.

Instead of technology coming to the defence of the poor few with the “uninsurable conditions” the insurance industry could advocate knowing better the condition of cables to all – by decreasing deductibles, increasing the level of cover or best still decreasing premiums.

This can easily be tied to the level of knowledge of the cable – a commitment to monitoring should increase the knowledge of the cable and should decrease the risk – insurers can price against risk and be able to act more competitively.

Regulators can operate knowing that cable condition can be more closely considered and could use the Innovation tools in the licence to encourage this approach rather than rigorously hold OFTO’s to approaches deemed correct at the time of licence. Permanent monitoring can be held more effective than occasional health checks – but both have value. OFGEM could encourage more innovation in transmission licence by including non-pricing measures in their calculations and nudge licencees towards new technology exploitation rather than swapping slices of a small pie.

In this future integrity specialists become not the pariahs of ambulance chasing but become oarsman guiding the asset owners to a stable future.

So who would be the winners?

- Insurers can account for risk with greater granularity and precision – and price more competitively – more knowledge = lower risk.

- Asset owners can sit more comfortably with greater knowledge of the condition of their portfolio – it also needn’t be a cost burden as more targeted knowledge can make inspection more regular and more precise. Rather than laboriously cover each metre of cable every few years, target the suspect locations every year – more quickly and more effectively.

- Regulators can continue to be backstop but with a significantly reduced exposure

- The O&M Community has greater depth to offer to the industry

And what needs done to create this Utopia?

Requirements for condition monitoring should be curated by an independent industry body – they aren’t a standard of “how” to carry out such work but rather they are a set of guidelines or requirements for the type and quality of output. More detailed information should leverage better insurance conditions.

At Indeximate we don’t intend to lob in problems without solutions – watch out for our next publication which will illustrate the next step forwards this with a free to adapt, creative commons licence set of requirements. We want to work with ALL stakeholders to move condition monitoring forwards.